Today, give a try to Techtonique web app, a tool designed to help you make informed, data-driven decisions using Mathematics, Statistics, Machine Learning, and Data Visualization. Here is a tutorial with audio, video, code, and slides: https://moudiki2.gumroad.com/l/nrhgb. 100 API requests are now (and forever) offered to every user every month, no matter the pricing tier.

R-vine copulas are powerful tools for modeling complex dependencies among multiple variables. The esgtoolkit package in R provides a user-friendly interface to fit R-vine copula models and generate synthetic data that preserves the statistical properties of the original dataset.

See also:

- https://docs.techtonique.net/ESGtoolkit/index.html

- https://docs.techtonique.net/ESGtoolkit/articles/syntheticopula.html

devtools::install_github("Techtonique/esgtoolkit")

library(esgtoolkit)

y <- esgtoolkit::calculatereturns(ts(EuStockMarkets[1:250, ], start=start(EuStockMarkets),

frequency=frequency(EuStockMarkets)), type = "log")

# Run simulation

result <- simulate_rvine(y, n = 500, verbose = TRUE, n_trials = 5)

# Print summary

print(result)

# Create different types of plots

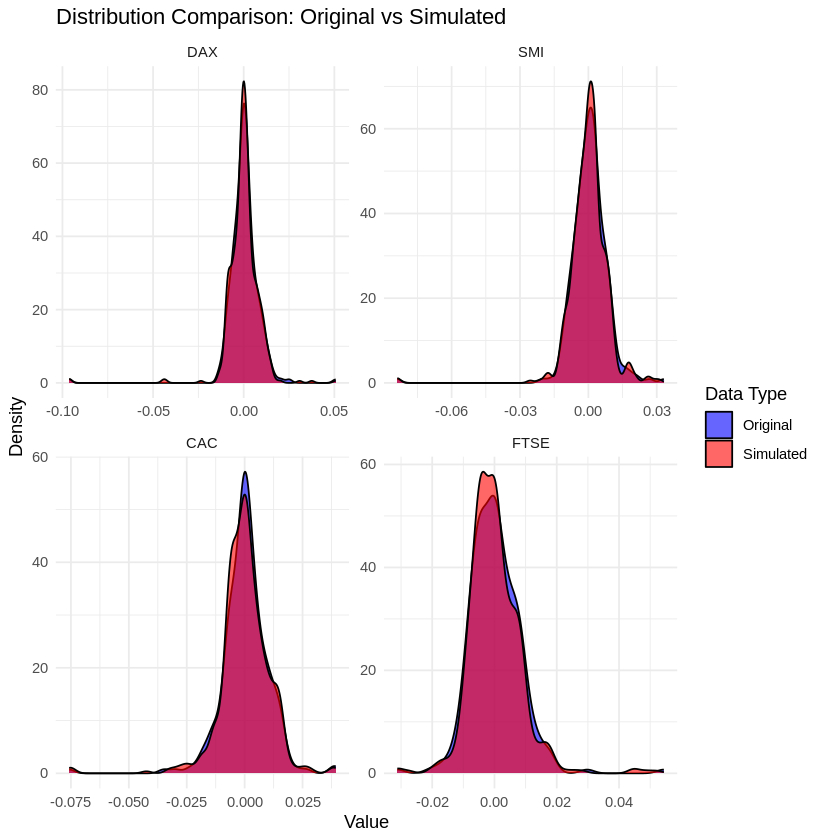

plot(result, type = "distribution") # Default

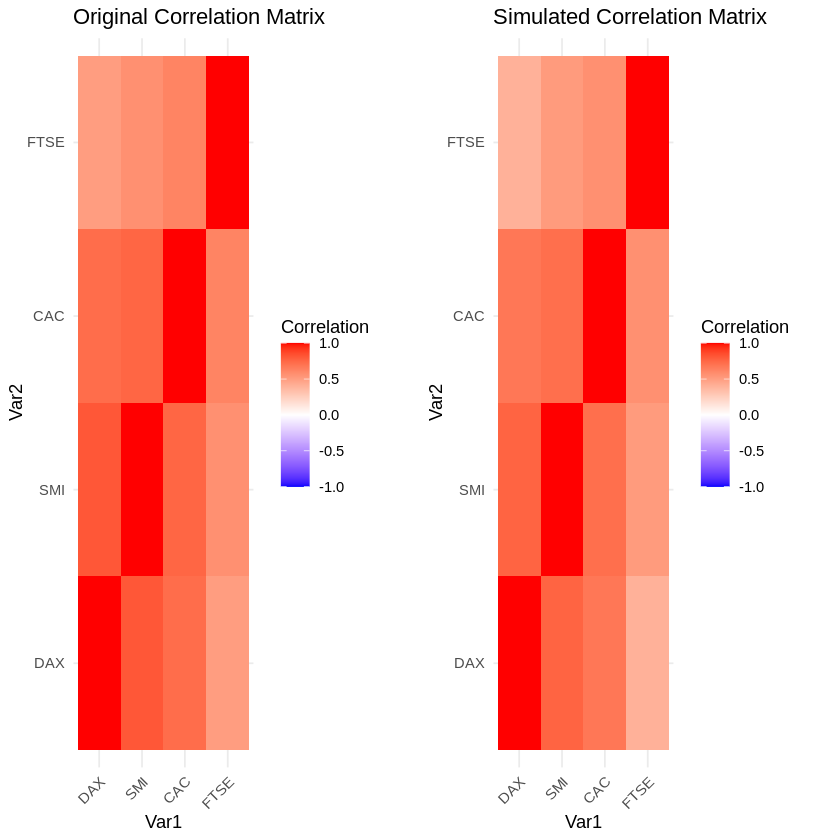

plot(result, type = "correlation")

#plot(result, type = "both")

# Access detailed diagnostics

str(result$diagnostics)

# Access simulated data

sim_data <- result$simulated_data

head(sim_data)

Transforming data to uniform margins with improved boundary handling...

Fitting R-vine copula model...

V1 + V3 --> V1,V3 ; V2

V2 + V4 --> V2,V4 ; V3

V1 + V4 --> V1,V4 ; V3,V2

R-vine copula model fitted successfully

tree edge | family cop par par2 | tau utd ltd

-----------------------------------------------------------

1 2,1 | 19 SBB7 2.03 0.69 | 0.47 0.36 0.59

3,2 | 19 SBB7 1.74 0.79 | 0.44 0.41 0.51

4,3 | 1 N 0.63 0.00 | 0.43 - -

2 3,1;2 | 1 N 0.33 0.00 | 0.21 - -

4,2;3 | 1 N 0.30 0.00 | 0.19 - -

3 4,1;3,2 | 14 SG 1.07 0.00 | 0.06 - 0.09

---

type: D-vine logLik: 249.86 AIC: -483.71 BIC: -455.57

---

1 <-> V1, 2 <-> V2, 3 <-> V3, 4 <-> V4 tree edge family cop par par2 tau utd ltd

1 1 4,3 1 N 0.6297866 0.0000000 0.43371534 0.0000000 0.00000000

2 1 3,2 19 SBB7 1.7362736 0.7864981 0.43642959 0.4142407 0.50934532

3 1 2,1 19 SBB7 2.0325295 0.6856104 0.46867955 0.3638576 0.59360896

4 2 4,2;3 1 N 0.2984383 0.0000000 0.19293140 0.0000000 0.00000000

5 2 3,1;2 1 N 0.3282026 0.0000000 0.21288575 0.0000000 0.00000000

6 3 4,1;3,2 14 SG 1.0683573 0.0000000 0.06398351 0.0000000 0.08676182

Running 5 simulation trials...

Best simulation achieved quality score: 0.0984

Score weights used: [0.4, 0.2, 0.2, 0.1, 0.1]

Mean absolute correlation error (Kendall): 0.0077

Mean absolute correlation error (Pearson): 0.0428

R-vine Copula Simulation Results

================================

Original observations: 249

Variables: 4

Simulated observations: 500

Quality score: 0.0984

Successful trials: 5/5

Mean absolute correlation error (Kendall): 0.0077

Mean absolute correlation error (Pearson): 0.0428

Use plot() to visualize results and $diagnostics for detailed metrics.

List of 24

$ original_correlation_tau : num [1:4, 1:4] 1 0.465 0.413 0.353 0.465 ...

..- attr(*, "dimnames")=List of 2

.. ..$ : chr [1:4] "DAX" "SMI" "CAC" "FTSE"

.. ..$ : chr [1:4] "DAX" "SMI" "CAC" "FTSE"

$ simulated_correlation_tau : num [1:4, 1:4] 1 0.45 0.421 0.355 0.45 ...

..- attr(*, "dimnames")=List of 2

.. ..$ : chr [1:4] "DAX" "SMI" "CAC" "FTSE"

.. ..$ : chr [1:4] "DAX" "SMI" "CAC" "FTSE"

$ correlation_error_tau : num [1:4, 1:4] 0 -0.01499 0.00825 0.00173 -0.01499 ...

..- attr(*, "dimnames")=List of 2

.. ..$ : chr [1:4] "DAX" "SMI" "CAC" "FTSE"

.. ..$ : chr [1:4] "DAX" "SMI" "CAC" "FTSE"

$ original_correlation_pearson : num [1:4, 1:4] 1 0.815 0.728 0.507 0.815 ...

..- attr(*, "dimnames")=List of 2

.. ..$ : chr [1:4] "DAX" "SMI" "CAC" "FTSE"

.. ..$ : chr [1:4] "DAX" "SMI" "CAC" "FTSE"

$ simulated_correlation_pearson: num [1:4, 1:4] 1 0.766 0.682 0.404 0.766 ...

..- attr(*, "dimnames")=List of 2

.. ..$ : chr [1:4] "DAX" "SMI" "CAC" "FTSE"

.. ..$ : chr [1:4] "DAX" "SMI" "CAC" "FTSE"

$ correlation_error_pearson : num [1:4, 1:4] 0 -0.0483 -0.0454 -0.1027 -0.0483 ...

..- attr(*, "dimnames")=List of 2

.. ..$ : chr [1:4] "DAX" "SMI" "CAC" "FTSE"

.. ..$ : chr [1:4] "DAX" "SMI" "CAC" "FTSE"

$ mean_absolute_error_tau : num 0.0077

$ max_absolute_error_tau : num 0.0232

$ mean_absolute_error_pearson : num 0.0428

$ max_absolute_error_pearson : num 0.103

$ quality_score : num 0.0984

$ score_weights_used : num [1:5] 0.4 0.2 0.2 0.1 0.1

$ trial_scores : num [1:5] 0.219 0.1222 0.0984 0.1231 0.1884

$ successful_trials : int 5

$ RVM_model :List of 20

..$ Matrix : num [1:4, 1:4] 1 4 3 2 0 2 4 3 0 0 ...

..$ family : num [1:4, 1:4] 0 14 1 19 0 0 1 19 0 0 ...

..$ par : num [1:4, 1:4] 0 1.068 0.328 2.033 0 ...

..$ par2 : num [1:4, 1:4] 0 0 0 0.686 0 ...

..$ names : chr [1:4] "V1" "V2" "V3" "V4"

..$ MaxMat : num [1:4, 1:4] 1 2 2 2 0 2 3 3 0 0 ...

..$ CondDistr :List of 2

.. ..$ direct : logi [1:4, 1:4] FALSE TRUE TRUE TRUE FALSE FALSE ...

.. ..$ indirect: logi [1:4, 1:4] FALSE FALSE FALSE FALSE FALSE TRUE ...

..$ type : chr "D-vine"

..$ tau : num [1:4, 1:4] 0 0.064 0.213 0.469 0 ...

..$ taildep :List of 2

.. ..$ upper: num [1:4, 1:4] 0 0 0 0.364 0 ...

.. ..$ lower: num [1:4, 1:4] 0 0.0868 0 0.5936 0 ...

..$ beta : num [1:4, 1:4] 0 0.062 0.213 0.443 0 ...

..$ call : language VineCopula::RVineStructureSelect(data = U, familyset = valid_families, type = 0, selectioncrit = "BIC", trun| __truncated__ ...

..$ nobs : int 249

..$ logLik : num 250

..$ pair.logLik: num [1:4, 1:4] 0 2.59 14.33 84.82 0 ...

..$ AIC : num -484

..$ pair.AIC : num [1:4, 1:4] 0 -3.18 -26.66 -165.65 0 ...

..$ BIC : num -456

..$ pair.BIC : num [1:4, 1:4] 0 0.341 -23.138 -158.615 0 ...

..$ emptau : num [1:4, 1:4] 0 0.0639 0.2156 0.4653 0 ...

..- attr(*, "class")= chr "RVineMatrix"

$ n_observations : int 249

$ n_variables : int 4

$ n_simulations : num 500

$ original_means : Named num [1:4] 0.000372 0.000456 0.000338 0.000255

..- attr(*, "names")= chr [1:4] "DAX" "SMI" "CAC" "FTSE"

$ simulated_means : Named num [1:4] -3.17e-05 2.18e-04 -4.52e-05 1.83e-04

..- attr(*, "names")= chr [1:4] "DAX" "SMI" "CAC" "FTSE"

$ original_sds : Named num [1:4] 0.00931 0.00877 0.01049 0.00815

..- attr(*, "names")= chr [1:4] "DAX" "SMI" "CAC" "FTSE"

$ simulated_sds : Named num [1:4] 0.00954 0.00886 0.01119 0.00849

..- attr(*, "names")= chr [1:4] "DAX" "SMI" "CAC" "FTSE"

$ ks_test_statistics : Named num [1:4] 0.0259 0.0354 0.0507 0.04

..- attr(*, "names")= chr [1:4] "D" "D" "D" "D"

$ ks_test_pvalues : num [1:4] 1 0.985 0.786 0.953

| DAX | SMI | CAC | FTSE |

|---|---|---|---|

| -0.001398544 | -0.0015309795 | 0.003170410 | 0.0008758254 |

| 0.004458917 | 0.0026640098 | 0.011666435 | 0.0057322484 |

| -0.001597764 | -0.0001979084 | -0.004832143 | 0.0011097778 |

| -0.001501251 | -0.0034774275 | -0.003218613 | 0.0020315141 |

| 0.000000000 | 0.0045969506 | 0.001912011 | -0.0044810433 |

| -0.002419004 | -0.0004654500 | -0.004832588 | -0.0055430360 |

For attribution, please cite this work as:

T. Moudiki (2025-09-21). Generating Synthetic Data with R-vine Copulas using esgtoolkit in R. Retrieved from https://thierrymoudiki.github.io/blog/2025/09/21/r/synthetic-copulas

BibTeX citation (remove empty spaces)

@misc{ tmoudiki20250921,

author = { T. Moudiki },

title = { Generating Synthetic Data with R-vine Copulas using esgtoolkit in R },

url = { https://thierrymoudiki.github.io/blog/2025/09/21/r/synthetic-copulas },

year = { 2025 } }

Previous publications

- My Presentation at Risk 2026: Lightweight Transfer Learning for Financial Forecasting Mar 1, 2026

- nnetsauce with and without jax for GPU acceleration Feb 23, 2026

- Understanding Boosted Configuration Networks (combined neural networks and boosting): An Intuitive Guide Through Their Hyperparameters Feb 16, 2026

- R version of Python package survivalist, for model-agnostic survival analysis Feb 9, 2026

- Presenting Lightweight Transfer Learning for Financial Forecasting (Risk 2026) Feb 4, 2026

- Option pricing using time series models as market price of risk Feb 1, 2026

- Enhancing Time Series Forecasting (ahead::ridge2f) with Attention-Based Context Vectors (ahead::contextridge2f) Jan 31, 2026

- Overfitting and scaling (on GPU T4) tests on nnetsauce.CustomRegressor Jan 29, 2026

- Beyond Cross-validation: Hyperparameter Optimization via Generalization Gap Modeling Jan 25, 2026

- GPopt for Machine Learning (hyperparameters' tuning) Jan 21, 2026

- rtopy: an R to Python bridge -- novelties Jan 8, 2026

- Python examples for 'Beyond Nelson-Siegel and splines: A model- agnostic Machine Learning framework for discount curve calibration, interpolation and extrapolation' Jan 3, 2026

- Forecasting benchmark: Dynrmf (a new serious competitor in town) vs Theta Method on M-Competitions and Tourism competitition Jan 1, 2026

- Finally figured out a way to port python packages to R using uv and reticulate: example with nnetsauce Dec 17, 2025

- Overfitting Random Fourier Features: Universal Approximation Property Dec 13, 2025

- Counterfactual Scenario Analysis with ahead::ridge2f Dec 11, 2025

- Zero-Shot Probabilistic Time Series Forecasting with TabPFN 2.5 and nnetsauce Dec 10, 2025

- ARIMA Pricing: Semi-Parametric Market price of risk for Risk-Neutral Pricing (code + preprint) Dec 7, 2025

- Analyzing Paper Reviews with LLMs: I Used ChatGPT, DeepSeek, Qwen, Mistral, Gemini, and Claude (and you should too + publish the analysis) Dec 3, 2025

- tisthemachinelearner: New Workflow with uv for R Integration of scikit-learn Dec 1, 2025

- (ICYMI) RPweave: Unified R + Python + LaTeX System using uv Nov 21, 2025

- unifiedml: A Unified Machine Learning Interface for R, is now on CRAN + Discussion about AI replacing humans Nov 16, 2025

- Context-aware Theta forecasting Method: Extending Classical Time Series Forecasting with Machine Learning Nov 13, 2025

- unifiedml in R: A Unified Machine Learning Interface Nov 5, 2025

- Deterministic Shift Adjustment in Arbitrage-Free Pricing (historical to risk-neutral short rates) Oct 28, 2025

- New instantaneous short rates models with their deterministic shift adjustment, for historical and risk-neutral simulation Oct 27, 2025

- RPweave: Unified R + Python + LaTeX System using uv Oct 19, 2025

- GAN-like Synthetic Data Generation Examples (on univariate, multivariate distributions, digits recognition, Fashion-MNIST, stock returns, and Olivetti faces) with DistroSimulator Oct 19, 2025

- Part2 of More data (> 150 files) on T. Moudiki's situation: a riddle/puzzle (including R, Python, bash interfaces to the game -- but everyone can play) Oct 16, 2025

- More data (> 150 files) on T. Moudiki's situation: a riddle/puzzle (including R, Python, bash interfaces to the game -- but everyone can play) Oct 12, 2025

- R port of llama2.c Oct 9, 2025

- Native uncertainty quantification for time series with NGBoost Oct 8, 2025

- NGBoost (Natural Gradient Boosting) for Regression, Classification, Time Series forecasting and Reserving Oct 6, 2025

- Real-time pricing with a pretrained probabilistic stock return model Oct 1, 2025

- Combining any model with GARCH(1,1) for probabilistic stock forecasting Sep 23, 2025

- Generating Synthetic Data with R-vine Copulas using esgtoolkit in R Sep 21, 2025

- Reimagining Equity Solvency Capital Requirement Approximation (one of my Master's Thesis subjects): From Bilinear Interpolation to Probabilistic Machine Learning Sep 16, 2025

- Transfer Learning using ahead::ridge2f on synthetic stocks returns Pt.2: synthetic data generation Sep 9, 2025

- Transfer Learning using ahead::ridge2f on synthetic stocks returns Sep 8, 2025

- I'm supposed to present 'Conformal Predictive Simulations for Univariate Time Series' at COPA CONFERENCE 2025 in London... Sep 4, 2025

- external regressors in ahead::dynrmf's interface for Machine learning forecasting Sep 1, 2025

- Another interesting decision, now for 'Beyond Nelson-Siegel and splines: A model-agnostic Machine Learning framework for discount curve calibration, interpolation and extrapolation' Aug 20, 2025

- Boosting any randomized based learner for regression, classification and univariate/multivariate time series forcasting Jul 26, 2025

- New nnetsauce version with CustomBackPropRegressor (CustomRegressor with Backpropagation) and ElasticNet2Regressor (Ridge2 with ElasticNet regularization) Jul 15, 2025

- mlsauce (home to a model-agnostic gradient boosting algorithm) can now be installed from PyPI. Jul 10, 2025

- A user-friendly graphical interface to techtonique dot net's API (will eventually contain graphics). Jul 8, 2025

- Calling =TECHTO_MLCLASSIFICATION for Machine Learning supervised CLASSIFICATION in Excel is just a matter of copying and pasting Jul 7, 2025

- Calling =TECHTO_MLREGRESSION for Machine Learning supervised regression in Excel is just a matter of copying and pasting Jul 6, 2025

- Calling =TECHTO_RESERVING and =TECHTO_MLRESERVING for claims triangle reserving in Excel is just a matter of copying and pasting Jul 5, 2025

- Calling =TECHTO_SURVIVAL for Survival Analysis in Excel is just a matter of copying and pasting Jul 4, 2025

- Calling =TECHTO_SIMULATION for Stochastic Simulation in Excel is just a matter of copying and pasting Jul 3, 2025

- Calling =TECHTO_FORECAST for forecasting in Excel is just a matter of copying and pasting Jul 2, 2025

- Random Vector Functional Link (RVFL) artificial neural network with 2 regularization parameters successfully used for forecasting/synthetic simulation in professional settings: Extensions (including Bayesian) Jul 1, 2025

- R version of 'Backpropagating quasi-randomized neural networks' Jun 24, 2025

- Backpropagating quasi-randomized neural networks Jun 23, 2025

- Beyond ARMA-GARCH: leveraging any statistical model for volatility forecasting Jun 21, 2025

- Stacked generalization (Machine Learning model stacking) + conformal prediction for forecasting with ahead::mlf Jun 18, 2025

- An Overfitting dilemma: XGBoost Default Hyperparameters vs GenericBooster + LinearRegression Default Hyperparameters Jun 14, 2025

- Programming language-agnostic reserving using RidgeCV, LightGBM, XGBoost, and ExtraTrees Machine Learning models Jun 13, 2025

- Exceptionally, and on a more personal note (otherwise I may get buried alive)... Jun 10, 2025

- Free R, Python and SQL editors in techtonique dot net Jun 9, 2025

- Beyond Nelson-Siegel and splines: A model-agnostic Machine Learning framework for discount curve calibration, interpolation and extrapolation Jun 7, 2025

- scikit-learn, glmnet, xgboost, lightgbm, pytorch, keras, nnetsauce in probabilistic Machine Learning (for longitudinal data) Reserving (work in progress) Jun 6, 2025

- R version of Probabilistic Machine Learning (for longitudinal data) Reserving (work in progress) Jun 5, 2025

- Probabilistic Machine Learning (for longitudinal data) Reserving (work in progress) Jun 4, 2025

- Python version of Beyond ARMA-GARCH: leveraging model-agnostic Quasi-Randomized networks and conformal prediction for nonparametric probabilistic stock forecasting (ML-ARCH) Jun 3, 2025

- Beyond ARMA-GARCH: leveraging model-agnostic Machine Learning and conformal prediction for nonparametric probabilistic stock forecasting (ML-ARCH) Jun 2, 2025

- Permutations and SHAPley values for feature importance in techtonique dot net's API (with R + Python + the command line) Jun 1, 2025

- Which patient is going to survive longer? Another guide to using techtonique dot net's API (with R + Python + the command line) for survival analysis May 31, 2025

- A Guide to Using techtonique.net's API and rush for simulating and plotting Stochastic Scenarios May 30, 2025

- Simulating Stochastic Scenarios with Diffusion Models: A Guide to Using techtonique.net's API for the purpose May 29, 2025

- Will my apartment in 5th avenue be overpriced or not? Harnessing the power of www.techtonique.net (+ xgboost, lightgbm, catboost) to find out May 28, 2025

- How long must I wait until something happens: A Comprehensive Guide to Survival Analysis via an API May 27, 2025

- Harnessing the Power of techtonique.net: A Comprehensive Guide to Machine Learning Classification via an API May 26, 2025

- Quantile regression with any regressor -- Examples with RandomForestRegressor, RidgeCV, KNeighborsRegressor May 20, 2025

- Survival stacking: survival analysis translated as supervised classification in R and Python May 5, 2025

- 'Bayesian' optimization of hyperparameters in a R machine learning model using the bayesianrvfl package Apr 25, 2025

- A lightweight interface to scikit-learn in R: Bayesian and Conformal prediction Apr 21, 2025

- A lightweight interface to scikit-learn in R Pt.2: probabilistic time series forecasting in conjunction with ahead::dynrmf Apr 20, 2025

- Extending the Theta forecasting method to GLMs, GAMs, GLMBOOST and attention: benchmarking on Tourism, M1, M3 and M4 competition data sets (28000 series) Apr 14, 2025

- Extending the Theta forecasting method to GLMs and attention Apr 8, 2025

- Nonlinear conformalized Generalized Linear Models (GLMs) with R package 'rvfl' (and other models) Mar 31, 2025

- Probabilistic Time Series Forecasting (predictive simulations) in Microsoft Excel using Python, xlwings lite and www.techtonique.net Mar 28, 2025

- Conformalize (improved prediction intervals and simulations) any R Machine Learning model with misc::conformalize Mar 25, 2025

- My poster for the 18th FINANCIAL RISKS INTERNATIONAL FORUM by Institut Louis Bachelier/Fondation du Risque/Europlace Institute of Finance Mar 19, 2025

- Interpretable probabilistic kernel ridge regression using Matérn 3/2 kernels Mar 16, 2025

- (News from) Probabilistic Forecasting of univariate and multivariate Time Series using Quasi-Randomized Neural Networks (Ridge2) and Conformal Prediction Mar 9, 2025

- Word-Online: re-creating Karpathy's char-RNN (with supervised linear online learning of word embeddings) for text completion Mar 8, 2025

- CRAN-like repository for most recent releases of Techtonique's R packages Mar 2, 2025

- Presenting 'Online Probabilistic Estimation of Carbon Beta and Carbon Shapley Values for Financial and Climate Risk' at Institut Louis Bachelier Feb 27, 2025

- Web app with DeepSeek R1 and Hugging Face API for chatting Feb 23, 2025

- tisthemachinelearner: A Lightweight interface to scikit-learn with 2 classes, Classifier and Regressor (in Python and R) Feb 17, 2025

- R version of survivalist: Probabilistic model-agnostic survival analysis using scikit-learn, xgboost, lightgbm (and conformal prediction) Feb 12, 2025

- Model-agnostic global Survival Prediction of Patients with Myeloid Leukemia in QRT/Gustave Roussy Challenge (challengedata.ens.fr): Python's survivalist Quickstart Feb 10, 2025

- A simple test of the martingale hypothesis in esgtoolkit Feb 3, 2025

- Command Line Interface (CLI) for techtonique.net's API Jan 31, 2025

- Gradient-Boosting and Boostrap aggregating anything (alert: high performance): Part5, easier install and Rust backend Jan 27, 2025

- Just got a paper on conformal prediction REJECTED by International Journal of Forecasting despite evidence on 30,000 time series (and more). What's going on? Part2: 1311 time series from the Tourism competition Jan 20, 2025

- Techtonique is out! (with a tutorial in various programming languages and formats) Jan 14, 2025

- Univariate and Multivariate Probabilistic Forecasting with nnetsauce and TabPFN Jan 14, 2025

- Just got a paper on conformal prediction REJECTED by International Journal of Forecasting despite evidence on 30,000 time series (and more). What's going on? Jan 5, 2025

- Python and Interactive dashboard version of Stock price forecasting with Deep Learning: throwing power at the problem (and why it won't make you rich) Dec 31, 2024

- Stock price forecasting with Deep Learning: throwing power at the problem (and why it won't make you rich) Dec 29, 2024

- No-code Machine Learning Cross-validation and Interpretability in techtonique.net Dec 23, 2024

- survivalist: Probabilistic model-agnostic survival analysis using scikit-learn, glmnet, xgboost, lightgbm, pytorch, keras, nnetsauce and mlsauce Dec 15, 2024

- Model-agnostic 'Bayesian' optimization (for hyperparameter tuning) using conformalized surrogates in GPopt Dec 9, 2024

- You can beat Forecasting LLMs (Large Language Models a.k.a foundation models) with nnetsauce.MTS Pt.2: Generic Gradient Boosting Dec 1, 2024

- You can beat Forecasting LLMs (Large Language Models a.k.a foundation models) with nnetsauce.MTS Nov 24, 2024

- Unified interface and conformal prediction (calibrated prediction intervals) for R package forecast (and 'affiliates') Nov 23, 2024

- GLMNet in Python: Generalized Linear Models Nov 18, 2024

- Gradient-Boosting anything (alert: high performance): Part4, Time series forecasting Nov 10, 2024

- Predictive scenarios simulation in R, Python and Excel using Techtonique API Nov 3, 2024

- Chat with your tabular data in www.techtonique.net Oct 30, 2024

- Gradient-Boosting anything (alert: high performance): Part3, Histogram-based boosting Oct 28, 2024

- R editor and SQL console (in addition to Python editors) in www.techtonique.net Oct 21, 2024

- R and Python consoles + JupyterLite in www.techtonique.net Oct 15, 2024

- Gradient-Boosting anything (alert: high performance): Part2, R version Oct 14, 2024

- Gradient-Boosting anything (alert: high performance) Oct 6, 2024

- Benchmarking 30 statistical/Machine Learning models on the VN1 Forecasting -- Accuracy challenge Oct 4, 2024

- Automated random variable distribution inference using Kullback-Leibler divergence and simulating best-fitting distribution Oct 2, 2024

- Forecasting in Excel using Techtonique's Machine Learning APIs under the hood Sep 30, 2024

- Techtonique web app for data-driven decisions using Mathematics, Statistics, Machine Learning, and Data Visualization Sep 25, 2024

- Parallel for loops (Map or Reduce) + New versions of nnetsauce and ahead Sep 16, 2024

- Adaptive (online/streaming) learning with uncertainty quantification using Polyak averaging in learningmachine Sep 10, 2024

- New versions of nnetsauce and ahead Sep 9, 2024

- Prediction sets and prediction intervals for conformalized Auto XGBoost, Auto LightGBM, Auto CatBoost, Auto GradientBoosting Sep 2, 2024

- Quick/automated R package development workflow (assuming you're using macOS or Linux) Part2 Aug 30, 2024

- R package development workflow (assuming you're using macOS or Linux) Aug 27, 2024

- A new method for deriving a nonparametric confidence interval for the mean Aug 26, 2024

- Conformalized adaptive (online/streaming) learning using learningmachine in Python and R Aug 19, 2024

- Bayesian (nonlinear) adaptive learning Aug 12, 2024

- Auto XGBoost, Auto LightGBM, Auto CatBoost, Auto GradientBoosting Aug 5, 2024

- Copulas for uncertainty quantification in time series forecasting Jul 28, 2024

- Forecasting uncertainty: sequential split conformal prediction + Block bootstrap (web app) Jul 22, 2024

- learningmachine for Python (new version) Jul 15, 2024

- learningmachine v2.0.0: Machine Learning with explanations and uncertainty quantification Jul 8, 2024

- My presentation at ISF 2024 conference (slides with nnetsauce probabilistic forecasting news) Jul 3, 2024

- 10 uncertainty quantification methods in nnetsauce forecasting Jul 1, 2024

- Forecasting with XGBoost embedded in Quasi-Randomized Neural Networks Jun 24, 2024

- Forecasting Monthly Airline Passenger Numbers with Quasi-Randomized Neural Networks Jun 17, 2024

- Automated hyperparameter tuning using any conformalized surrogate Jun 9, 2024

- Recognizing handwritten digits with Ridge2Classifier Jun 3, 2024

- Forecasting the Economy May 27, 2024

- A detailed introduction to Deep Quasi-Randomized 'neural' networks May 19, 2024

- Probability of receiving a loan; using learningmachine May 12, 2024

- mlsauce's `v0.18.2`: various examples and benchmarks with dimension reduction May 6, 2024

- mlsauce's `v0.17.0`: boosting with Elastic Net, polynomials and heterogeneity in explanatory variables Apr 29, 2024

- mlsauce's `v0.13.0`: taking into account inputs heterogeneity through clustering Apr 21, 2024

- mlsauce's `v0.12.0`: prediction intervals for LSBoostRegressor Apr 15, 2024

- Conformalized predictive simulations for univariate time series on more than 250 data sets Apr 7, 2024

- learningmachine v1.1.2: for Python Apr 1, 2024

- learningmachine v1.0.0: prediction intervals around the probability of the event 'a tumor being malignant' Mar 25, 2024

- Bayesian inference and conformal prediction (prediction intervals) in nnetsauce v0.18.1 Mar 18, 2024

- Multiple examples of Machine Learning forecasting with ahead Mar 11, 2024

- rtopy (v0.1.1): calling R functions in Python Mar 4, 2024

- ahead forecasting (v0.10.0): fast time series model calibration and Python plots Feb 26, 2024

- A plethora of datasets at your fingertips Part3: how many times do couples cheat on each other? Feb 19, 2024

- nnetsauce's introduction as of 2024-02-11 (new version 0.17.0) Feb 11, 2024

- Tuning Machine Learning models with GPopt's new version Part 2 Feb 5, 2024

- Tuning Machine Learning models with GPopt's new version Jan 29, 2024

- Subsampling continuous and discrete response variables Jan 22, 2024

- DeepMTS, a Deep Learning Model for Multivariate Time Series Jan 15, 2024

- A classifier that's very accurate (and deep) Pt.2: there are > 90 classifiers in nnetsauce Jan 8, 2024

- learningmachine: prediction intervals for conformalized Kernel ridge regression and Random Forest Jan 1, 2024

- A plethora of datasets at your fingertips Part2: how many times do couples cheat on each other? Descriptive analytics, interpretability and prediction intervals using conformal prediction Dec 25, 2023

- Diffusion models in Python with esgtoolkit (Part2) Dec 18, 2023

- Diffusion models in Python with esgtoolkit Dec 11, 2023

- Julia packaging at the command line Dec 4, 2023

- Quasi-randomized nnetworks in Julia, Python and R Nov 27, 2023

- A plethora of datasets at your fingertips Nov 20, 2023

- A classifier that's very accurate (and deep) Nov 12, 2023

- mlsauce version 0.8.10: Statistical/Machine Learning with Python and R Nov 5, 2023

- AutoML in nnetsauce (randomized and quasi-randomized nnetworks) Pt.2: multivariate time series forecasting Oct 29, 2023

- AutoML in nnetsauce (randomized and quasi-randomized nnetworks) Oct 22, 2023

- Version v0.14.0 of nnetsauce for R and Python Oct 16, 2023

- A diffusion model: G2++ Oct 9, 2023

- Diffusion models in ESGtoolkit + announcements Oct 2, 2023

- An infinity of time series forecasting models in nnetsauce (Part 2 with uncertainty quantification) Sep 25, 2023

- (News from) forecasting in Python with ahead (progress bars and plots) Sep 18, 2023

- Forecasting in Python with ahead Sep 11, 2023

- Risk-neutralize simulations Sep 4, 2023

- Comparing cross-validation results using crossval_ml and boxplots Aug 27, 2023

- Reminder Apr 30, 2023

- Did you ask ChatGPT about who you are? Apr 16, 2023

- A new version of nnetsauce (randomized and quasi-randomized 'neural' networks) Apr 2, 2023

- Simple interfaces to the forecasting API Nov 23, 2022

- A web application for forecasting in Python, R, Ruby, C#, JavaScript, PHP, Go, Rust, Java, MATLAB, etc. Nov 2, 2022

- Prediction intervals (not only) for Boosted Configuration Networks in Python Oct 5, 2022

- Boosted Configuration (neural) Networks Pt. 2 Sep 3, 2022

- Boosted Configuration (_neural_) Networks for classification Jul 21, 2022

- A Machine Learning workflow using Techtonique Jun 6, 2022

- Super Mario Bros © in the browser using PyScript May 8, 2022

- News from ESGtoolkit, ycinterextra, and nnetsauce Apr 4, 2022

- Explaining a Keras _neural_ network predictions with the-teller Mar 11, 2022

- New version of nnetsauce -- various quasi-randomized networks Feb 12, 2022

- A dashboard illustrating bivariate time series forecasting with `ahead` Jan 14, 2022

- Hundreds of Statistical/Machine Learning models for univariate time series, using ahead, ranger, xgboost, and caret Dec 20, 2021

- Forecasting with `ahead` (Python version) Dec 13, 2021

- Tuning and interpreting LSBoost Nov 15, 2021

- Time series cross-validation using `crossvalidation` (Part 2) Nov 7, 2021

- Fast and scalable forecasting with ahead::ridge2f Oct 31, 2021

- Automatic Forecasting with `ahead::dynrmf` and Ridge regression Oct 22, 2021

- Forecasting with `ahead` Oct 15, 2021

- Classification using linear regression Sep 26, 2021

- `crossvalidation` and random search for calibrating support vector machines Aug 6, 2021

- parallel grid search cross-validation using `crossvalidation` Jul 31, 2021

- `crossvalidation` on R-universe, plus a classification example Jul 23, 2021

- Documentation and source code for GPopt, a package for Bayesian optimization Jul 2, 2021

- Hyperparameters tuning with GPopt Jun 11, 2021

- A forecasting tool (API) with examples in curl, R, Python May 28, 2021

- Bayesian Optimization with GPopt Part 2 (save and resume) Apr 30, 2021

- Bayesian Optimization with GPopt Apr 16, 2021

- Compatibility of nnetsauce and mlsauce with scikit-learn Mar 26, 2021

- Explaining xgboost predictions with the teller Mar 12, 2021

- An infinity of time series models in nnetsauce Mar 6, 2021

- New activation functions in mlsauce's LSBoost Feb 12, 2021

- 2020 recap, Gradient Boosting, Generalized Linear Models, AdaOpt with nnetsauce and mlsauce Dec 29, 2020

- A deeper learning architecture in nnetsauce Dec 18, 2020

- Classify penguins with nnetsauce's MultitaskClassifier Dec 11, 2020

- Bayesian forecasting for uni/multivariate time series Dec 4, 2020

- Generalized nonlinear models in nnetsauce Nov 28, 2020

- Boosting nonlinear penalized least squares Nov 21, 2020

- Statistical/Machine Learning explainability using Kernel Ridge Regression surrogates Nov 6, 2020

- NEWS Oct 30, 2020

- A glimpse into my PhD journey Oct 23, 2020

- Submitting R package to CRAN Oct 16, 2020

- Simulation of dependent variables in ESGtoolkit Oct 9, 2020

- Forecasting lung disease progression Oct 2, 2020

- New nnetsauce Sep 25, 2020

- Technical documentation Sep 18, 2020

- A new version of nnetsauce, and a new Techtonique website Sep 11, 2020

- Back next week, and a few announcements Sep 4, 2020

- Explainable 'AI' using Gradient Boosted randomized networks Pt2 (the Lasso) Jul 31, 2020

- LSBoost: Explainable 'AI' using Gradient Boosted randomized networks (with examples in R and Python) Jul 24, 2020

- nnetsauce version 0.5.0, randomized neural networks on GPU Jul 17, 2020

- Maximizing your tip as a waiter (Part 2) Jul 10, 2020

- New version of mlsauce, with Gradient Boosted randomized networks and stump decision trees Jul 3, 2020

- Announcements Jun 26, 2020

- Parallel AdaOpt classification Jun 19, 2020

- Comments section and other news Jun 12, 2020

- Maximizing your tip as a waiter Jun 5, 2020

- AdaOpt classification on MNIST handwritten digits (without preprocessing) May 29, 2020

- AdaOpt (a probabilistic classifier based on a mix of multivariable optimization and nearest neighbors) for R May 22, 2020

- AdaOpt May 15, 2020

- Custom errors for cross-validation using crossval::crossval_ml May 8, 2020

- Documentation+Pypi for the `teller`, a model-agnostic tool for Machine Learning explainability May 1, 2020

- Encoding your categorical variables based on the response variable and correlations Apr 24, 2020

- Linear model, xgboost and randomForest cross-validation using crossval::crossval_ml Apr 17, 2020

- Grid search cross-validation using crossval Apr 10, 2020

- Documentation for the querier, a query language for Data Frames Apr 3, 2020

- Time series cross-validation using crossval Mar 27, 2020

- On model specification, identification, degrees of freedom and regularization Mar 20, 2020

- Import data into the querier (now on Pypi), a query language for Data Frames Mar 13, 2020

- R notebooks for nnetsauce Mar 6, 2020

- Version 0.4.0 of nnetsauce, with fruits and breast cancer classification Feb 28, 2020

- Create a specific feed in your Jekyll blog Feb 21, 2020

- Git/Github for contributing to package development Feb 14, 2020

- Feedback forms for contributing Feb 7, 2020

- nnetsauce for R Jan 31, 2020

- A new version of nnetsauce (v0.3.1) Jan 24, 2020

- ESGtoolkit, a tool for Monte Carlo simulation (v0.2.0) Jan 17, 2020

- Search bar, new year 2020 Jan 10, 2020

- 2019 Recap, the nnetsauce, the teller and the querier Dec 20, 2019

- Understanding model interactions with the `teller` Dec 13, 2019

- Using the `teller` on a classifier Dec 6, 2019

- Benchmarking the querier's verbs Nov 29, 2019

- Composing the querier's verbs for data wrangling Nov 22, 2019

- Comparing and explaining model predictions with the teller Nov 15, 2019

- Tests for the significance of marginal effects in the teller Nov 8, 2019

- Introducing the teller Nov 1, 2019

- Introducing the querier Oct 25, 2019

- Prediction intervals for nnetsauce models Oct 18, 2019

- Using R in Python for statistical learning/data science Oct 11, 2019

- Model calibration with `crossval` Oct 4, 2019

- Bagging in the nnetsauce Sep 25, 2019

- Adaboost learning with nnetsauce Sep 18, 2019

- Change in blog's presentation Sep 4, 2019

- nnetsauce on Pypi Jun 5, 2019

- More nnetsauce (examples of use) May 9, 2019

- nnetsauce Mar 13, 2019

- crossval Mar 13, 2019

- test Mar 10, 2019

Comments powered by Talkyard.