Today, give a try to Techtonique web app, a tool designed to help you make informed, data-driven decisions using Mathematics, Statistics, Machine Learning, and Data Visualization. Here is a tutorial with audio, video, code, and slides: https://moudiki2.gumroad.com/l/nrhgb

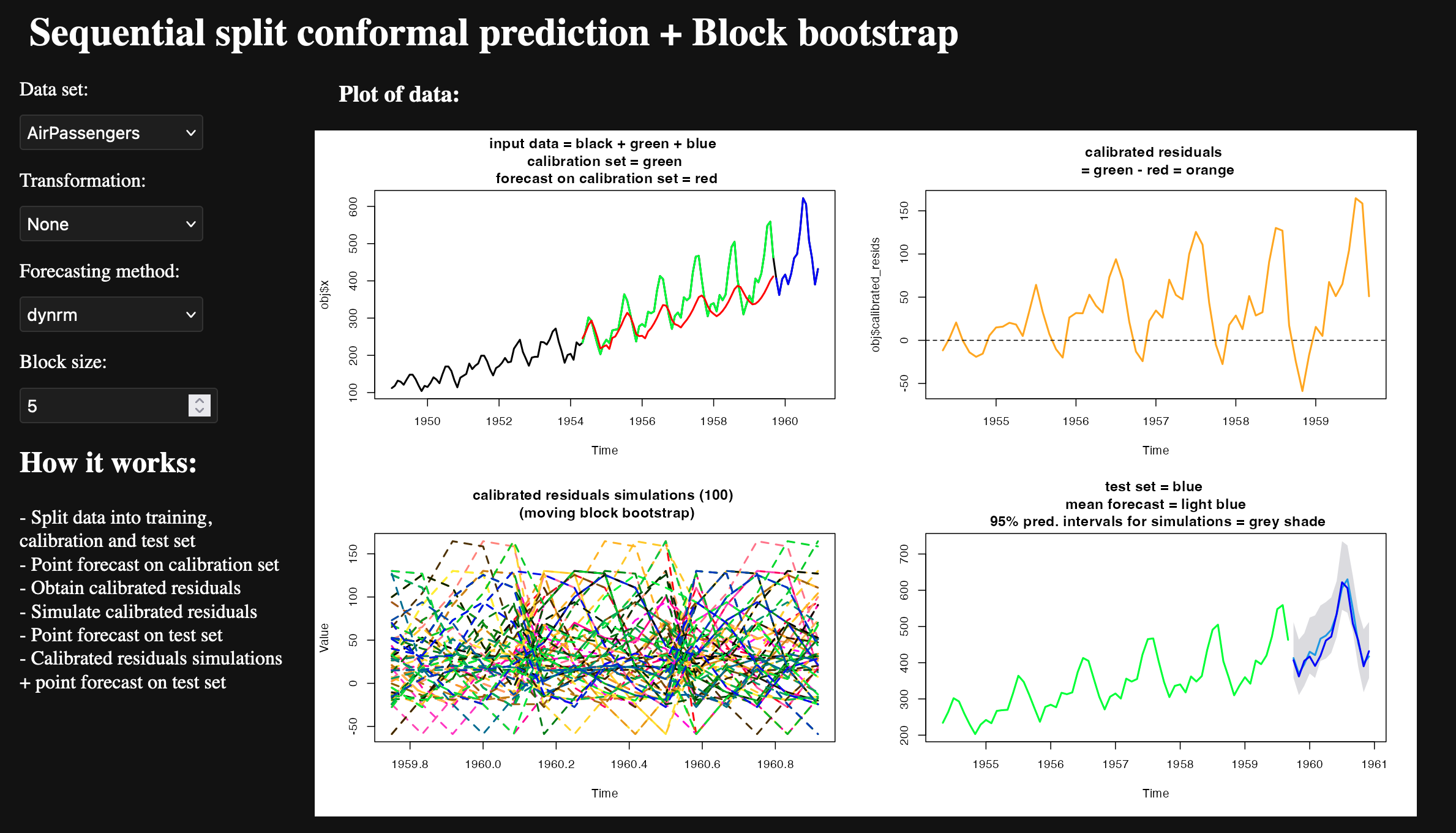

This post was firstly submitted to the Applied Quantitative Investment Management group on LinkedIn. It illustrates a recipe implemented in Python package nnetsauce for time series forecasting uncertainty quantification (through simulation): sequential split conformal prediction + block bootstrap

Underlying algorithm:

- Split data into training set, calibration set and test set

- Obtain point forecast on calibration set

- Obtain calibrated residuals = point forecast on calibration set - true observation on calibration set

- Simulate calibrated residuals using block bootstrap

- Obtain Point forecast on test set

- Prediction = Calibrated residuals simulations + point forecast on test set

Interested in experimenting more? Here is a web app.

For more details, you can read (under review): https://www.researchgate.net/publication/379643443_Conformalized_predictive_simulations_for_univariate_time_series

Comments powered by Talkyard.